Search for an answer or browse help topics

How do you calculate peak margin and how does it work?

Margin is calculated differently based on the various securities. For F&O, the margin is SPAN + Exposure. For stocks, the margin required is VAR + ELM. You can use the margin calculator for different securities provided by FLATTRADE by clicking the link https://flattrade.in/margin-calculator

Let us assume that a trader buys 1 lot of BankNifty and the margin requirement comes to around Rs 360 approximately. Now, the trader buys some shares in cash segment for equity delivery and the margin requirement comes to around Rs 100. So the total margin or the maximum margin requirement right now will Rs 460 (Rs 360 + Rs 100). This would be the peak margin for the day.

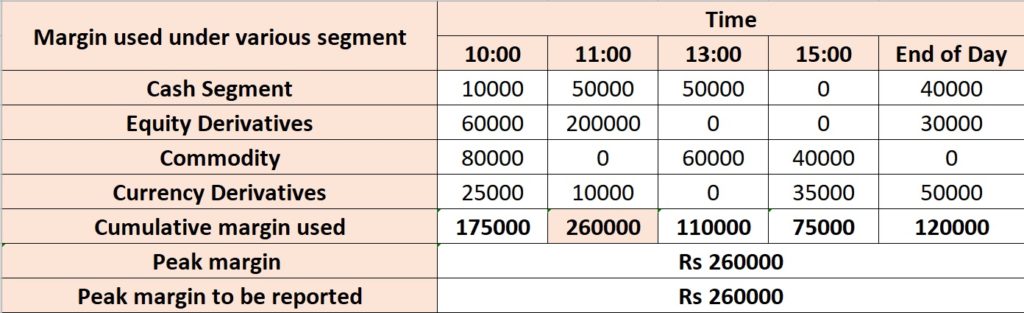

To understand a more complicated scenario, let us look at the table below.

As mentioned above, four random snapshots are taken at different times during the trading hours across various segments. Among them, Rs 2,60,000 is the peak margin as per the table and that should be available in the trading account of a client for him/her to execute the trade.

FLATTRADE makes it simple for you to maintain the desired margin because the required margin is calculated automatically and displayed in trading software. So, as a trader, all you have to do is to make sure the margin amount is present in your trading account before you place an order.

Though, FLATTRADE gives its client timely updates if there is any margin shortfall through different channels such as push notifications, SMS, email alerts, it is the responsibility of the trader to mandatorily adhere to the margin requirement rules.

Web Trading

Web Trading Backoffice

Backoffice IPO Apply

IPO Apply Manage Account

Manage Account Wall

Wall Kosh

Kosh