You can transfer shares from one demat account to another by either closing the old demat account and transferring shares to the new demat account or you can keep the old demat account and just transfer your shares from the old demat account to the new demat account. To close the older demat account, you must not hold any shares in the particular demat account and there should not be any negative balance in the old demat account. or you can transfer online using CDSL Easiest.

In this scenario, you can close your account with exisiting brokerage and transfer your shares from old demat account to new demat account. In this process, you can close your current account with your exiting broker and move your holdings to new demat account.

You have to submit closure and transfer form along with Client Master Report (CMR) from your new broker to your existing broker. A Client Master Report (CMR) is a digitally signed or physically signed certificate issued by the new broker to a client with the details of their demat account such as demat ID, date of birth, bank details, nomination details etc. CMR copy is used to transfer stocks in a demat account from one broker to another.

To proceed with this process, firstly, you have to get a Delivery Instruction Slip (DIS) from your existing broker. Normally, this DIS will come with your welcome kit when you had opened a demat account though a broker. In this slip, all the necessary information related to the transfer of shares must be filled and only then the shares will be transferred. The mandatory details that must be given in DIS are as follow,

Beneficiary Broker ID – This will be the 16 digit ID of the broker. On this slip, you have to provide the ID of both the current/existing broker and the new broker.

International Securities Identification Number – This is created to identify the individual shares and is to be entered carefully in the slip as the same will be transferred to the ID you have entered.

You must also mention if it is a inter-depository or intra-depository transfer.

After filling up the DIS with the details, you have to sign the slip. After these steps, you will submit it to the existing broker. The charges for this transfer will vary according to various brokers.

Both the process must be completed manually to transfer your shares from other brokers to Flattrade. In both the cases, you can transfer shares only when the Beneficiary Owner (BO) status is same. For example, you can transfer shares from an individual account to an individual account only. You cannot transfer shares from an individual account to a Joint/NRI/HUF account and vice versa.

CDSL Easiest share transfer method is an online mode of transferring shares from one demat account to another demat account. The client has to register and create an account in the CDSL Easiest login. To do the registration keep your Client Master report which has the details of the client ID and Demat account from the broker demat account you want to transfer. Also, keep the CMR you received from Flattrade.

Steps to register for Easiest on CDSL

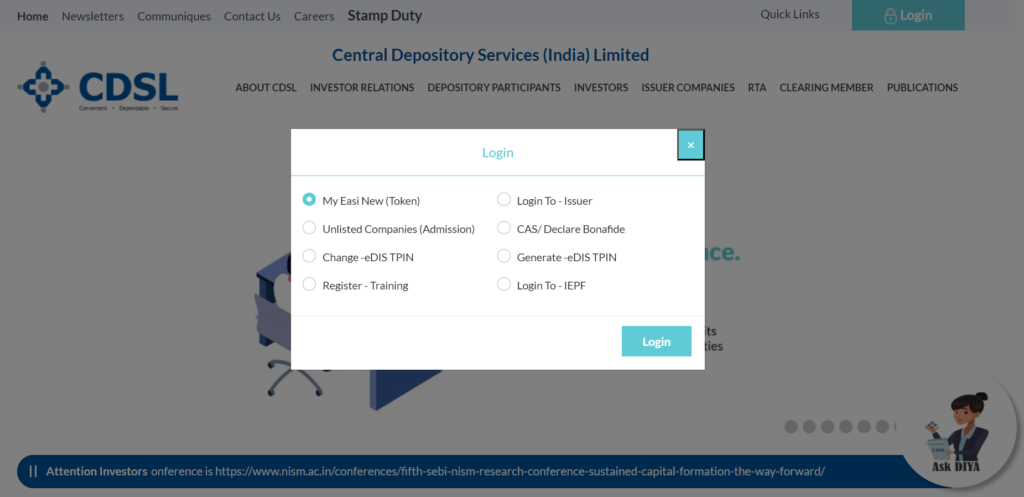

1: Go to cdslindia.com and click on “Login to My Easi New (Token)” :

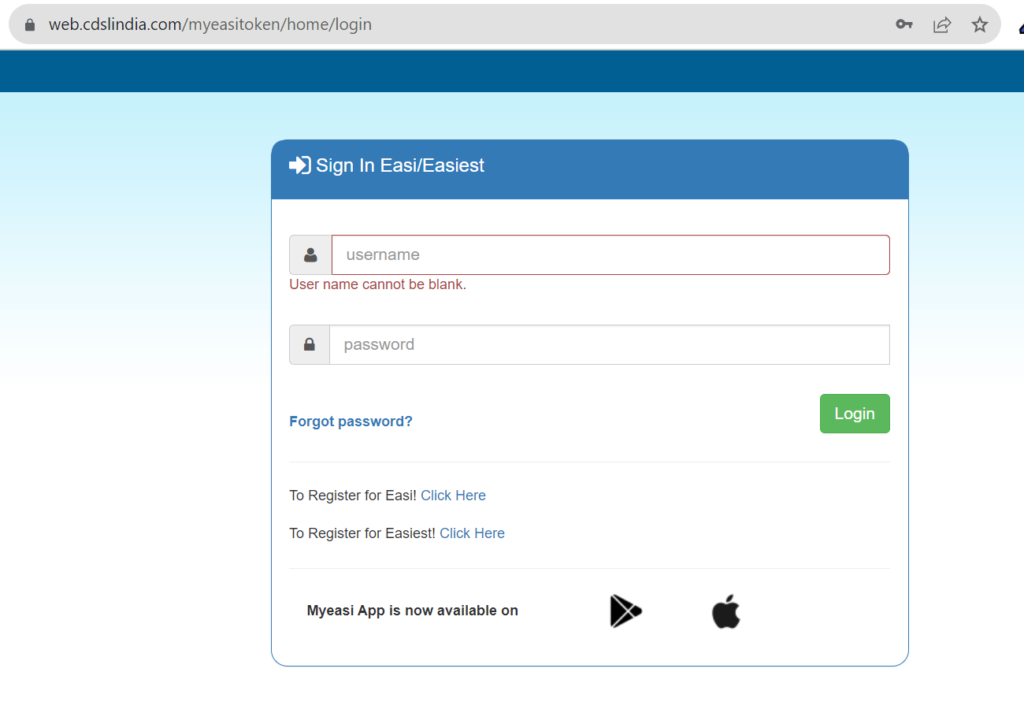

2: Click on ‘To register for easiest click here”

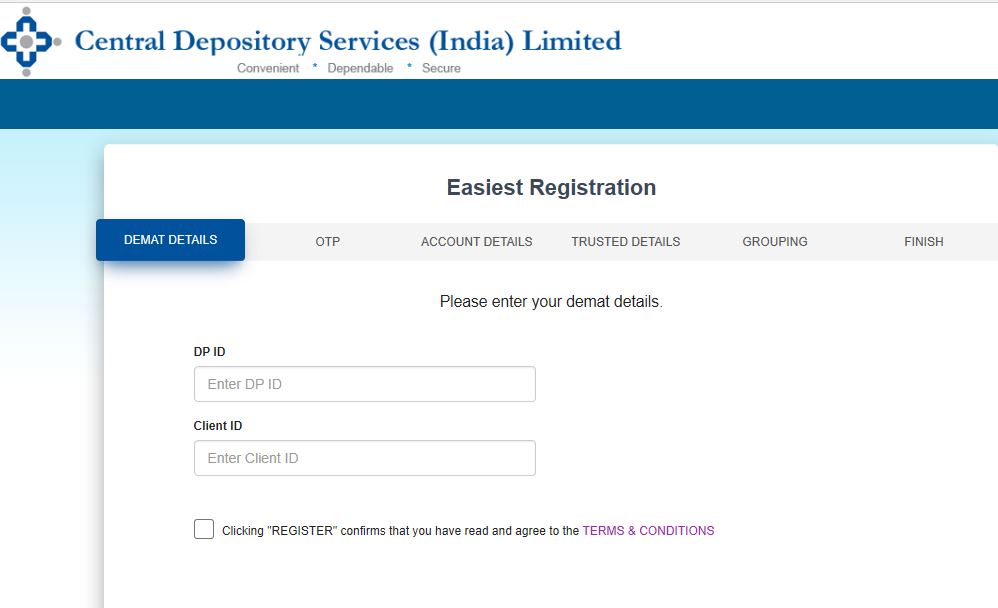

3. Enter your Client ID and DP ID from the broker to whom you want to transfer the shares. The first eight digits of your Demat number are the same as your DP-ID and the next eight numbers are the same as your Client ID.

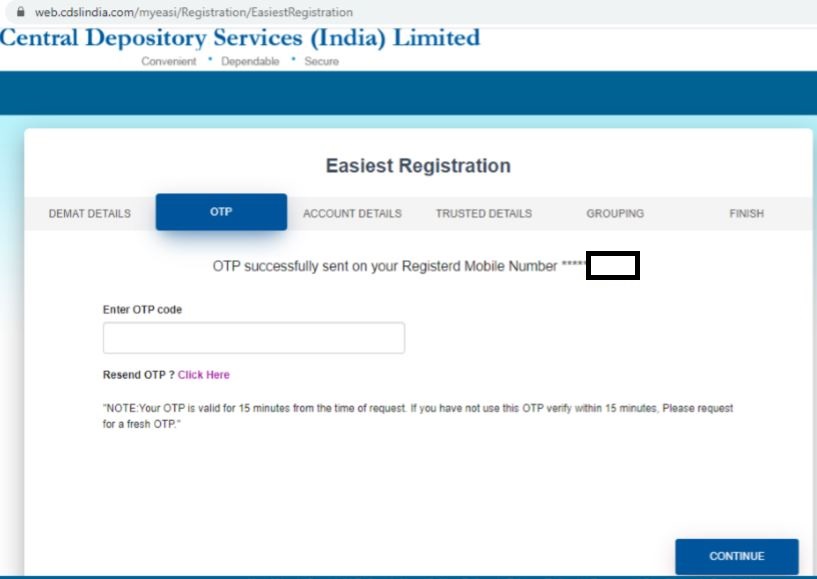

4: Enter the OTP, you have received on your registered mobile number. Enter the OTP and click on Continue to proceed.

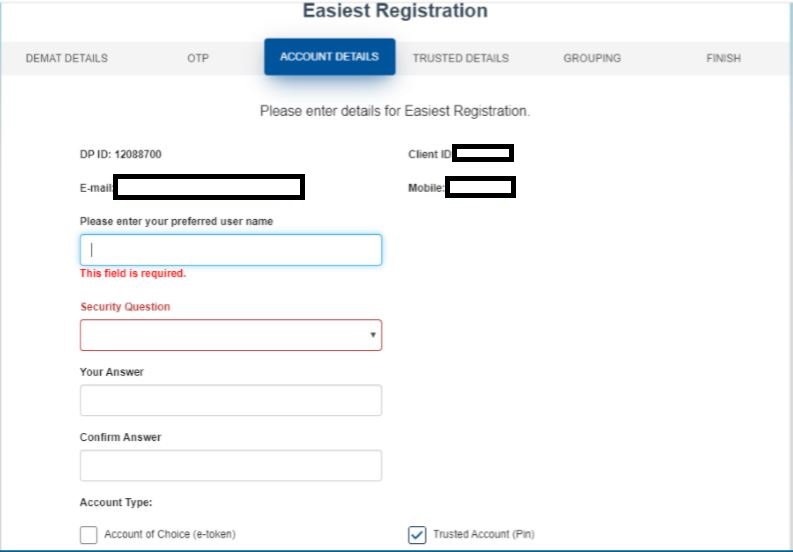

5: Fill the necessary details and select the account type as “Trusted Account (PIN)”

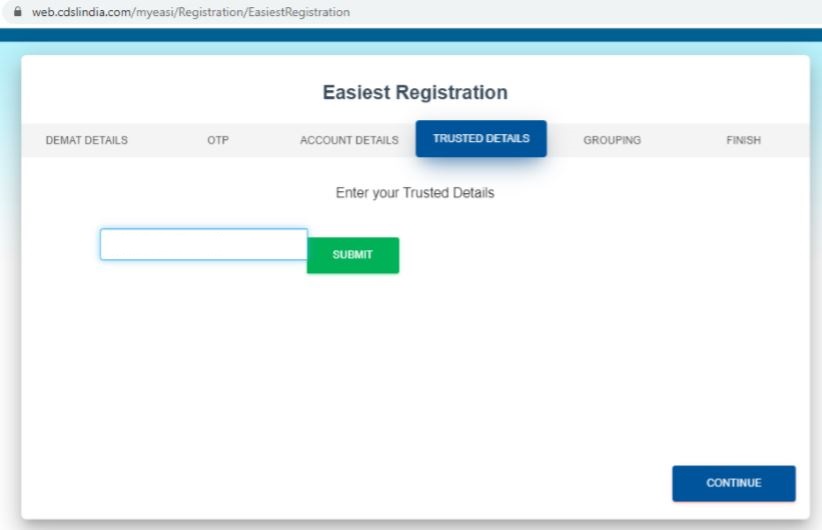

6: Enter your Trusted account details. Trusted details refer to the broker you are transferring the shares. So here, you are required to enter your Flattrade Demat account number. You can find it in the CMR copy or you can find it under “My Account” section on the wall platform. Flattrade Demat’s number is 16 digits and starts with 12080300.

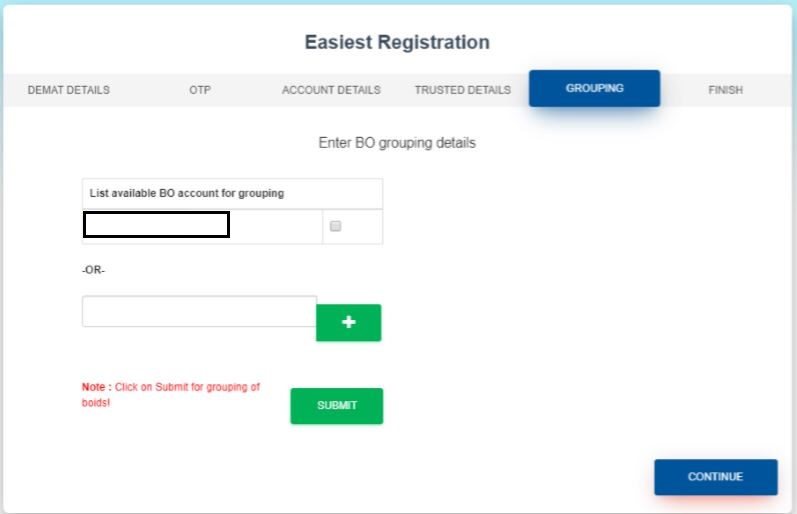

7: In the grouping section, if you have holdings in multiple Demat accounts. you can enter the Demat account details of each of these brokers and click on the ‘+’ sign to add the entries.

Please note: you can add details of brokers who are registered with CDSL only (up to 4 such entries are allowed).

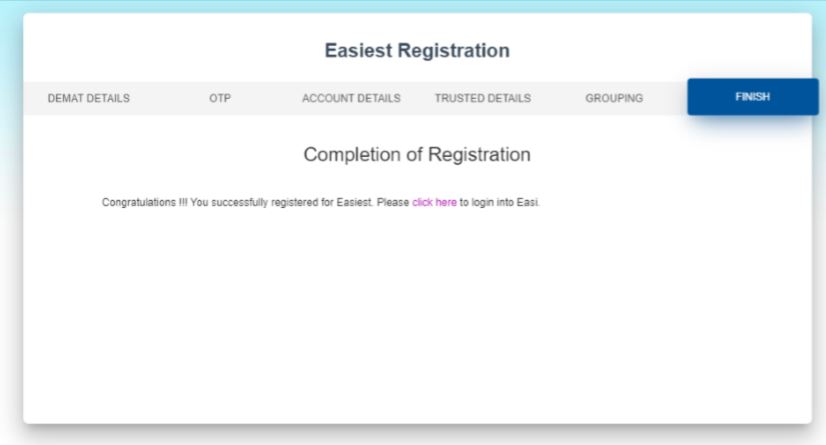

The details you enter will be verified by the brokers ( depository participants) and post-authentication you will receive a registration confirmation.

8: The registration is now complete. You will receive your login credentials – Login ID, password, and PIN, in your registered email.

Steps to transfer shares to Flattrade account using CDSL Easiest

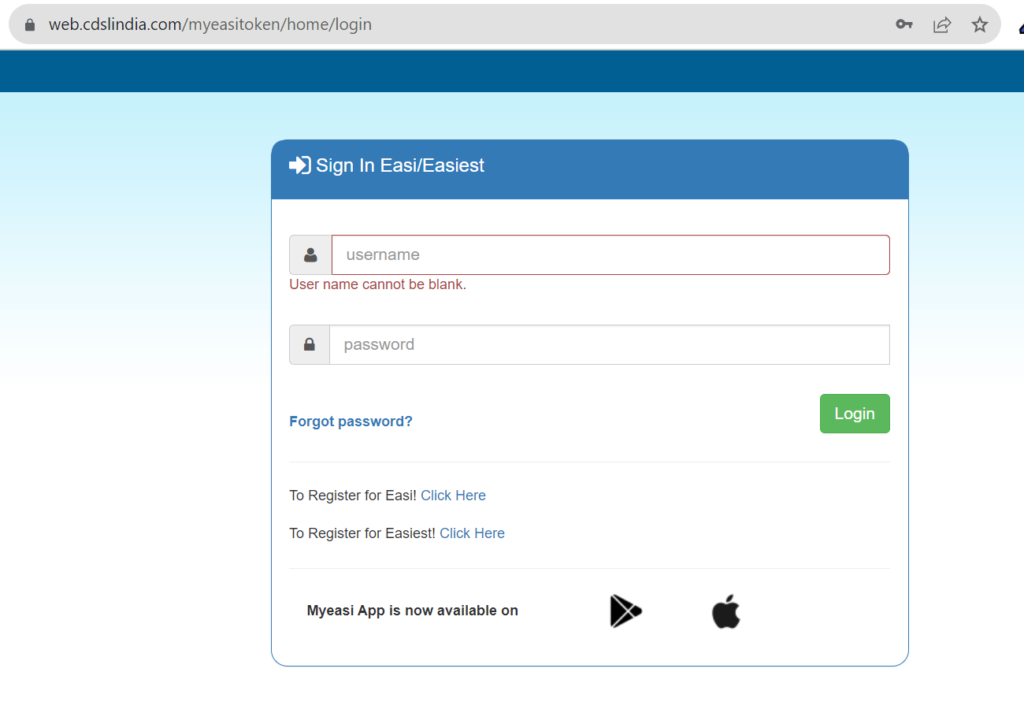

1: Log in to the CDSL Easiest – with the credentials you have received.

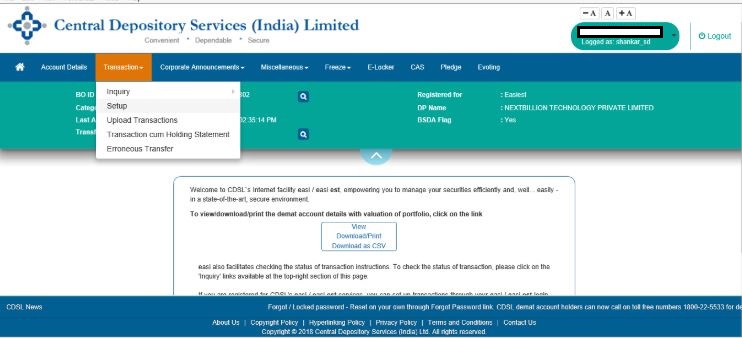

2: Click on the tab Transaction and select Setup for transferring stocks through Easiest.

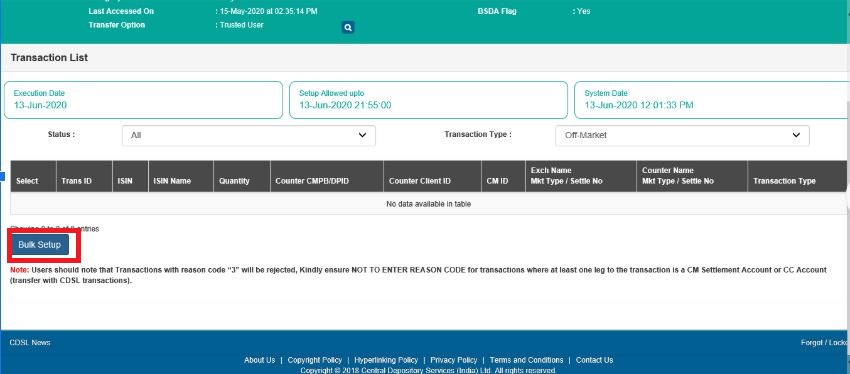

3: In Transaction, Setup select the Bulk Setup option.

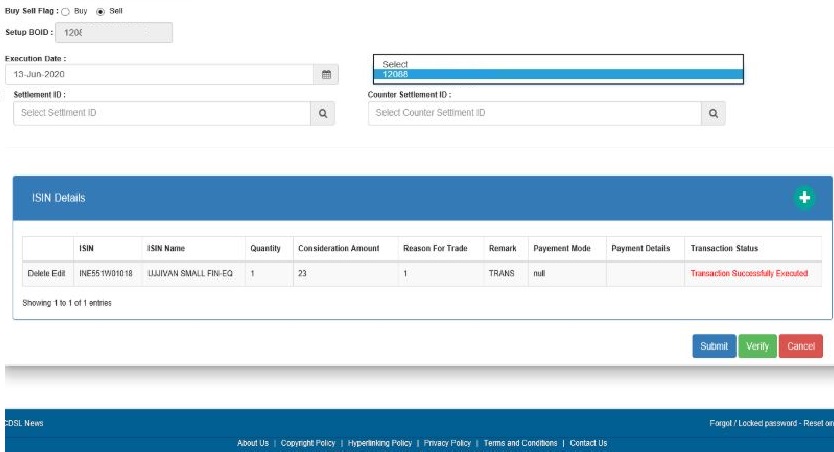

4. Select the “+” icon to add the ISIN, quantity and the reason for transfer off-market details, Submit and continue.

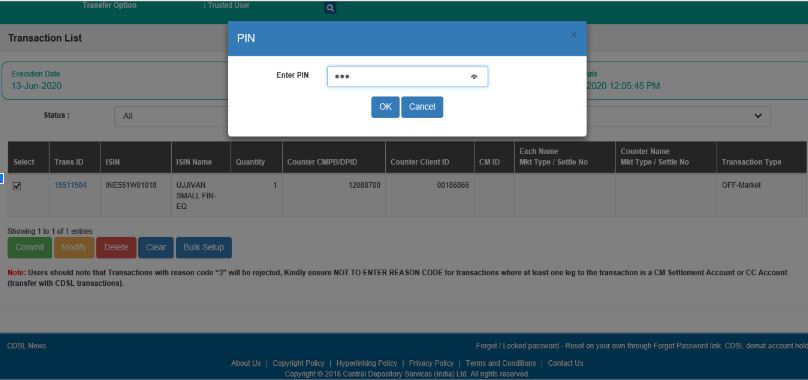

5: On verification select the option for COMMIT & enter the OTP PIN received on your registered mobile no.

6: Once it is completed, Flattrade Depository team will authenticate it. You will receive communication from CDSL and from our end as well once the authentication process is completed. You will be able to see your external holdings on the Flattrade demat account once the process is completed. If there are any details required you can write to [email protected].