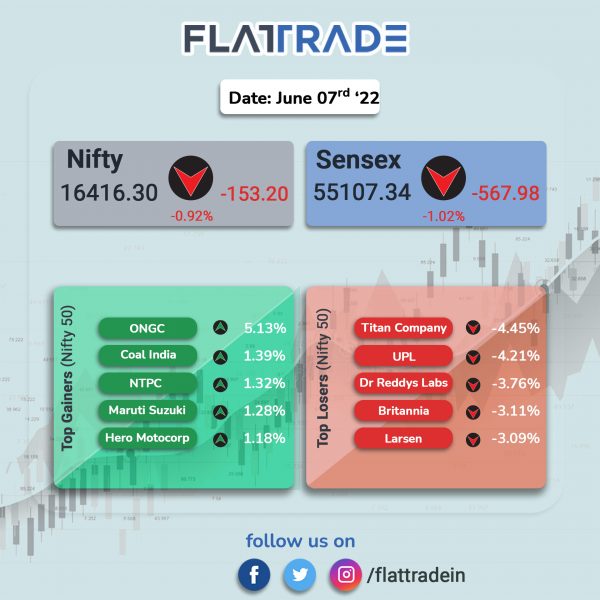

Benchmark indices ended 1% lower a day ahead of the RBI’s monetary policy outcome, dragged by IT, FMCG and pharma stocks. The Sensex fell 1.02% and Nifty dropped 0.92%.

In broader markets, Nifty Midcap 100 and BSE Smallcap was down 0.67%, each.

Top losers among Nifty sectoral indices were Realty [-1.67%], Media [-1.6%], IT [-1.57%], FMCG [-1.54%] and Pharma [-1.07%]. Top gainers were Energy [1.05%] and Auto [0.52%].

Indian rupee fell 8 paise to 77.71 against the US dollar on Tuesday.

Stock in News Today

Adani Group and Apollo Hospitals Enterprise Ltd: The Adani Group and Apollo Hospitals are evaluating bids to take a majority stake in Metropolis Healthcare Ltd, according to Mint. Adani and Apollo’s deal with Metropolis could be at least worth $1 billion, Mint reported quoting two people familiar with the matter.

HDFC Bank: The private sector lender raised marginal cost based lending rate (MCLR) by 35 basis points across tenures. The rate hikes are effective from Tuesday. Its one year MCLR rate has been raised to 7.85%, from 7.5% earlier.

Life Insurance Corporation: Shares of the company hit a new low and closed at Rs 753 apiece on NSE against its issue price of Rs 949 per equity share. The lock-in period of 30 days for anchor investors will end mid-June.

PB Fintech: Share of the company tumbled 11.51% the company informed in a regulatory filing that its Chairman and CEO Yashish Dahiya plans to sell up to 37,69,471 shares via bulk deals on the stock exchanges.

Mangalore Refinery & Petrochemicals (MRPL) and Chennai Petroleum Corporation (CPCL): Share of MRPL closed 19.5% higher and CPCL jumped 15.06% amid heavy volumes due to strong outlook for both the companies. The rise in the companies’ share prices comes amid increase in Singapore Gross Refining Margins to $25.2 per barrel as well as surge in global crude oil prices.

Aurobindo Pharma: The drug manufacturer’s subsidiary Eugia Pharma has received a final approval from the US FDA to manufacture and market drug used to treat prostrate cancer. The product will be launched in June and its estimated market size is worth $83 million for twelve months ending April 2022.

Defence manufacturing Companies: Shares of defence manufacturers rose after Defence Ministry gave its approval to procure range of indigenous equipment worth Rs 76,390 crore. Top gainers were Bharat Dynamics [3.73%], Paras Defence [1.22%] and Bharat Electronics [0.99%].

Zydus Lifesciences: The company has received final approval from the US FDA to market Adapalene and Benzoyl Peroxide Topical Gel. The combination is used to decrease the number and severity of acne pimples. The drug will be manufactured at its Ahmedabad facility.