Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.44% higher at 16,497, signalling that Dalal Street was headed for a positive start on Wednesday.

Asian shares were trading higher, tracking Wall Street overnight gains, boosted by technology stocks. Japan’s Nikkei 225 rose 0.95% and Topix index was 1.07% higher. China’s Hang Seng climbed 2.14% and CSI 300 rose 0.86%.

Indian rupee fell 8 paise to 77.71 against the US dollar on Tuesday.

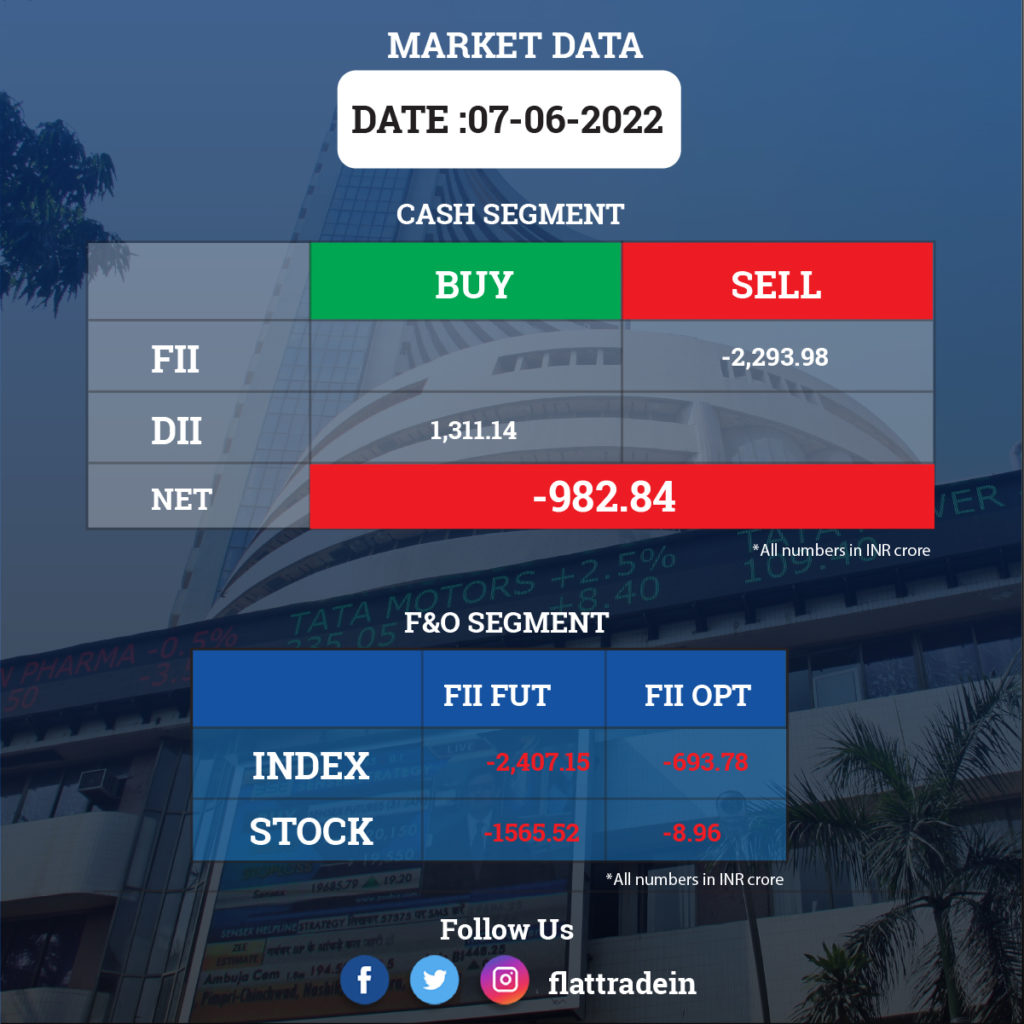

FII/DII Trading Data

Stocks in News Today

State Bank of India (SBI): The government has appointed Alok Kumar Choudhary as the managing director of the state-run lender for two years. Choudhary, who was deputy managing director (finance), had started his career at SBI as a probationary officer.

Adani Power: The company has agreed to acquire infra firms Support Properties and Eternus Real Estate for Rs 280.1 crore and Rs 329.3 crore, respectively.

Punjab National Bank (PNB): The state-run bank’s board has approved an investment of Rs 500 crore by participating in the rights issue of PNB Housing Finance. The latter is also looking to raise Rs 2,000 crore by issuing non convertible debentures (NCD) on a private placement basis.

Future Group stocks: E-commerce major Amazon has sent a notice to Future Group promoters asking them to refrain from entering into any kind of transaction with Reliance Industries NSE 0.19 % group either directly or indirectly, source aware of the development said.

Indian Hotels: The Tata groups hotel firm announced the signing of a 88-rooms Vivanta hotel in Jammu, Jammu and Kashmir. The existing hotel will be upgraded into the Vivanta brand post renovation.

Hindustan Copper: The company restarted mining operations at the Surda mine in Ghatshila, Jharkhand, after the renewal of the lease by the Government of Jharkhand and obtaining the required Environment Clearance from the Ministry of Environment.

Wockhardt: The pharma company has appointed Deepak Madnani as the Chief Financial Officer with immediate effect on June 7. The decision was taken after Pramod Gupta informed the company that he would not be able to continue as the Chief Financial Officer.

Zee Entertainment Enterprises: Life Insurance Corporation of India bought additional two lakh equity shares in the company through open market transactions. With this, LIC’s stake in the company stands increased to 5.008%, an increase from 4.988 percent earlier.

Sharika Enterprises: The company has received a purchase order from Voith Hydro Private Limited. The company will supply 220KV XLPE cable package for Voith Hydro Naitwar Mori project for a total value of Rs 4.6 crore.

RITES: The transport infrastructure consultancy and engineering company signed a memorandum of understanding (MoU) with Grands Trains DU Senegal (GTS-S.A), a railroad company of Senegal. Under the MoU, the company would provide technical cooperation in the railway sector including rail transportation, supply of rolling stock, railway infrastructure development, modernization of workshops, IT solutions for railway operations, and upgradation of signalling, telecommunication, and rail monitoring systems.

Cineline India: The company informed exchanges that the board of directors approved the issuance of up to 27 lakh warrants for Rs 35.10 crore to promoters by way of a preferential issue. These warrants are convertible into equity shares within 18 months at a price of Rs 130 per share. The company will also monetise property – Eternity Mall, at Nagpur for Rs 60 crore.

South India Bank: The bank’s board has approved a proposal to raise up to Rs 2,000 crore in foreign currencies via public of private issue including GDRs.