Market Opening - An Overview

SGX Nifty futures were trading 0.93% higher at 16,489 signalling Dalal Street was headed for a positive opening.

Asian markets were trading higher as investors’ confidence were boosted after the Chinese government lifted some coronavirus curbs in Shanghai.

The Indian rupee ended flat at 77.56 against the US dollar on Friday.

Ethos, the luxury and premium watch retailer, in the country will make its debut on Dalal Street on Monday. Its IPO issue was overall subscribed 1.04 times only.

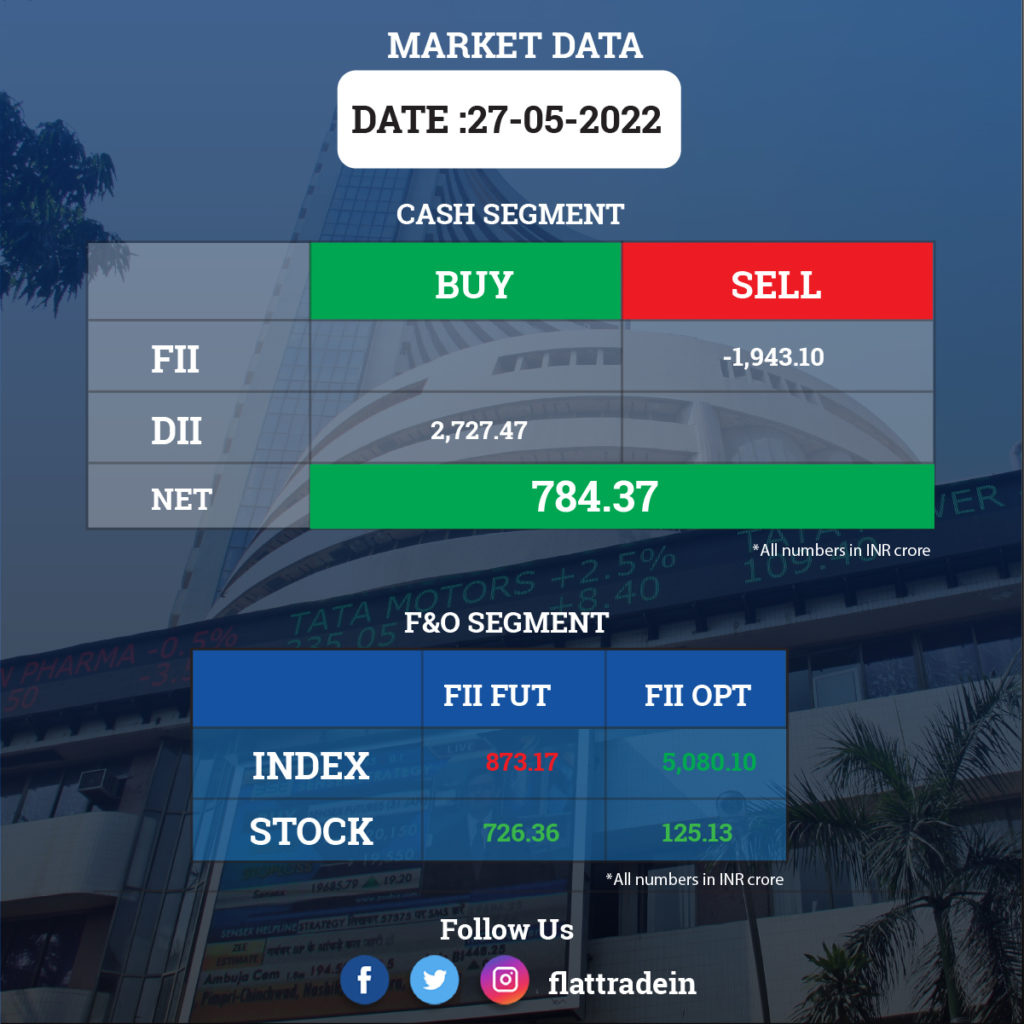

FII/DII Trading Data

Upcoming Results

Life Insurance Corporation of India, Jubilant Foodworks, Sun Pharma, Aurobindo Pharma, Campus Activewear, IRCTC, Coffe Day Enterprises, LT Foods (Daawat), Dilip Buildcon, DCM Shriram Industries, Delhivery, Dhampur Sugar, Dhani Services, Dish TV, Dixon Technologies, Dredging Corporation of India, Eureka Forbes, Jindal Steel & Power, Lux Industries, Mazagon Dock Shipbuilders, Mawana Sugar, Mcleod Russel, Medplus Health, Natco Pharma, Prudent Corporate Advisory Services, Radico Khaitan, SpiceJet, Stove Kraft, and Wockhardt will release their quarterly results.

Stocks in News Today

Oil & Natural Gas Corp (ONGC): The state-owned company reported a 10% rise in consolidated net profit at Rs 12,061 crore for the quarter ending 31, 2022 due to higher prices for crude oil it produces and sells. It reported consolidated net profit of Rs 10,963 crore in the year-ago period. Its consolidated revenue from operations rose 37% to Rs 1.55 trillion in Q4FY22 as against Rs 1.14 trillion in Q4FY21. For FY22, the company’s board recommended a final dividend of Rs 3.25 per equity share of Rs 5 face value.

Mahindra & Mahindra (M&M): The automaker reported nearly five-fold jump in standalone profit at Rs 1,192 crore for quarter ended March 2022. The company had posted a profit of Rs 245 crore for the year-ago period. Revenue grew 28 per cent to Rs 17,124 crore in the period under review as compared with Rs 13,356 crore in March quarter 2020-21, it said.

Adani Group: The company’s commercial drones division is exploring two revenue models — dealer-based and service-based — while keeping its primary focus on the agriculture sector, Rangarajan Vijayaraghavan, Vice President, Strategy and Chairman’s Office, Adani Group, told PTI in an interview. The comments came a day after the conglomerate announced acquiring 50% equity stake in drone start-up General Aeronautics.

JSW Steel: The metal major reported a 20% decline in its consolidated net profit to Rs 3,343 crore for the March 2022 quarter, dragged by higher expenses. The company had clocked Rs 4,191 crore net profit in January-March 2020-21.

United Spirits: The Diageo-controlled liquor maker reported a 12.14% decline in consolidated net profit at Rs 178.6 crore for the fourth quarter ended March as margins were impacted by rising inflation. The company had posted a net profit of Rs 203.3 crore in the year-ago period.

FSN E-Commerce (Nykaa): The company reported a decline of about 57% in its consolidated profit to Rs 7.57 crore for the fourth quarter ended March 2022, mainly account of new investments. The company had registered a profit of Rs 17.9 crore in the same period a year ago.

Sun TV Network: The television broadcaster reported a 15.92% decline in consolidated profit after tax at Rs 410.17 crore in the fourth quarter ended March 2022. The company had posted a consolidated profit after tax of Rs 487.86 crore in the same quarter previous fiscal.

Welspun Corp: The iron and steel products maker said its consolidated net profit fell by 30% to Rs 263.56 crore in the quarter ended March on account of higher expenses. The company had posted a net profit of Rs 372.63 crore in the same period of FY21.

Oil India: The state-owned oil exploration and production firm reported its highest-ever quarterly net profit in the three months to March as it got nearly USD 100 per barrel price for oil produced and sold. Net profit at Rs 1,630.01 crore in January-March was almost double of Rs 847.56 crore profit in the same period of last year.

Shipping Corporation of India: The state owned shipping firm reported a 77.42% jump in its consolidated profit to Rs 152.16 crore for the fourth quarter ended March 2022. The state-owned company had clocked a consolidated profit of Rs 85.76 crore for the corresponding quarter in 2020-21.

PTC India Financial Services: The state run NBFC reported a 67% decline in its consolidated net profit to Rs 6.93 crore in the third quarter ended December 2021. The company’s net profit stood at Rs 20.85 crore in the October-December period of the previous fiscal.

City Union Bank: The private sector lender reported a 88% jump in its net profit at Rs 208.96 crore for the quarter ended March 2022 on the back of fall in provisions for bad loans and contingencies. The bank had posted a net profit of Rs 111.19 crore in the corresponding quarter a year ago.

Arvind Fashions: The textile player reported a consolidated net profit of Rs 22.38 crore for the fourth quarter ended March 2022. The company had posted a consolidated net loss after tax of Rs 99.45 crore in the same quarter previous fiscal.

IFB Industries: The household appliance firm reported a consolidated net loss of Rs 28.29 crore for fourth quarter ended March 31, 2022. The company had posted a net profit of Rs 7.71 crore for January-March period a year ago.

Transport Corporation of India (TCI): The integrated supply chain and logistics solutions provider reported a 38% year-on-year growth in standalone profit after tax (PAT) to Rs 73.10 crore for the March quarter. The company had posted a profit of Rs 52.86 crore in the fourth quarter of the fiscal year ended on March 31, 2021.

Hindustan Copper: The state-owned company posted a consolidated net profit of Rs 88.99 crore for quarter ended March 2022. It had posted a net loss of Rs 36.81 crore for the year-ago period. Income increased to Rs 561.47 crore in the reported quarter from Rs 531.55 crore in the year-ago period.

Godfrey Phillips India: Cigarette maker reported a 9.07% increase in its consolidated net profit to Rs 103.88 crore for the quarter ended March 2022. It had posted a net profit of Rs 95.24 crore in the year-ago period. Its total income was up 2.84% to Rs 877.77 crore during the quarter under review as against Rs 853.48 crore in the corresponding period of the previous fiscal.

ITC: The cigarette to FMCG company said it has acquired a 10.07 per cent stake in Blupin Technologies, the company behind direct-to-consumer (D2C) brand, Mylo. The investment will provide the company an early mover advantage in the evolving content-to-community-to-commerce space and will provide an expanded presence in the D2C space, ITC said.

General Insurance Corporation of India (GIC Re): The company registered higher after tax profit and gross premium income last year. During FY22, the GIC Re earned a gross premium income of Rs 43,208.46 crore in FY22 compared to Rs 47,014.38 crore for the year ended on March 2021. Last fiscal the reinsurer had earned an after tax profit of Rs.2,005.74 crore as compared to Rs 1,920.44 crore logged in FY21. The company’s Board of Directors has declared an interim dividend of Rs 2.25 per equity share (on face value of Rs 5 each) for the year under review.

Glenmark Pharmaceuticals: The company said its consolidated profit after tax declined 26% to Rs 173 crore for the fourth quarter ended March 2022. The company had reported a profit after tax (PAT) of Rs 234 crore in the January-March period of 2020-21 fiscal. Consolidated revenues of the drug firm, however, rose to Rs 3,019 crore in the quarter under review as compared to Rs 2,860 crore in the year-ago period, recording an increase of 6% year-on-year.

United Spirits (USL): The company will sell its portfolio of 32 brands to Inbrew Breweries Private Ltd for Rs 820 crore. Inbrew is owned by Indian entrepreneur Ravi Deol. USL will retain the McDowell’s and Director’s Special whiskey brands.

JK Tyre and Industries: The company has planned a capital expenditure of Rs 1,100 crore till next financial year, its CFO Sanjeev Aggarwal said. The tyre maker plans to invest in capacity expansion as well as regular maintenance of the existing infrastructure.

Inox Wind: The company has reported widening of its consolidated net loss to Rs 255.76 crore for the March 2022 quarter, mainly due to lower revenues. Its consolidated net loss of the company stood at Rs 105.87 crore in the quarter ended 2021. Total income in the quarter dropped to Rs 183.92 crore from Rs 295.46 crore in the year-ago period.

Brookfield India Real Estate Trust: The entity plans to raise up to Rs 5,000 crore through sales of units to institutional investors, as per a regulatory filing. The units will be issued through an institutional placement in one or more tranches, it added.

Garware Hi-Tech Films Ltd (GHFL): The company’s profit after tax soared by about 42% to Rs 45.12 crore in January-March 2022 quarter. GHFL had posted a PAT of Rs 31.80 crore in the same quarter of FY2021, the company said. Its revenue on a consolidated basis rose by over 12% to around Rs 324 crore in the last quarter of FY22 compared to Rs 287 crore in the year-ago period.