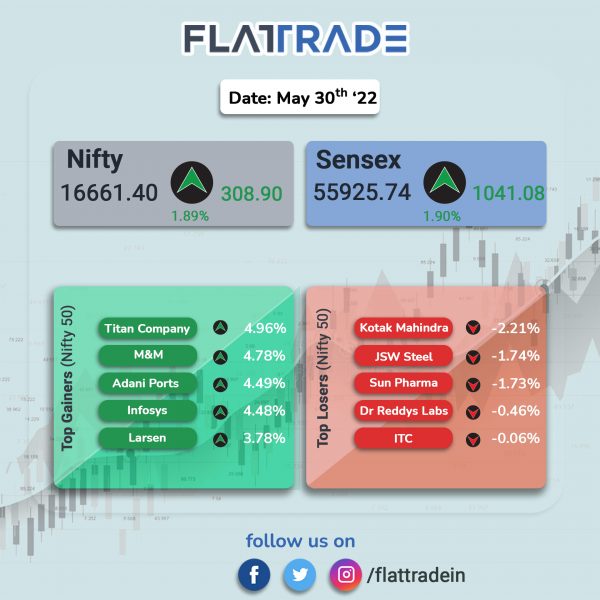

Major stock indices closed higher boosted by gains in IT and auto stocks. In addition, investors’ optimism were boosted as the Chinese government lifted some coronavirus lockdown. The Sensex jumped 1.9% and and the Nifty soared 1.89%.

Broader markets rose tracking benchmark indices. The Nifty Midcap 100 soared 2.42% and BSE Smallcap advanced 2.23%.

Top gainers in Nifty sectoral indices were Realty [4.06%], IT [3.88%], Media [3.21%], PSU Bank [3.21%] and Auto [1.96%]. [1.04%]. Pharma index [0.01%] was nearly little changed.

Indian rupee closes little changed at 77.54 against the US dollar on Monday.

Stock in News Today

Tata Motors: The Indian automaker and Ford India have signed an MoU with Gujarat government for the potential acquisition of Ford India’s Sanand vehicle manufacturing facility. The acquisition will include land and buildings, vehicle manufacturing plant, machinery and equipment. The acquisition will increase Tata Motors’ production capacity to 3,00,000 units per year.

Tata Motors plans to invest in new machinery and equipment at the plant post the acquisition.

Larsen & Toubro (L&T): Shares of the engineering and construction company rose over 3% after the company announced that its construction arm has been awarded another significant contract for Chennai Metro Rail Project. L&T classifies significant orders as those with value between Rs 1,000 crore and Rs 2,500 crore. The project involves construction of an elevated viaduct of 10 km including elevated ramp and ten elevated metro stations in the city. The construction is to be completed in 35 months.

Adani Group and State Bank of India: The Gautam Adani-led group is in talks with the State Bank of India to raise about Rs 12,000 crore in long-term project loans that would be utilised for building Ganga Expressway. SBI is engaged in a road traffic survey before loan terms are finalised, The Economic Times reported citing three people familiar with the matter.

Sun Pharma: The company psoted a net loss of Rs 2277.25 crore in Q4FY22 as against a net profit of Rs 894.15 crore in the same period a year ago. Its total revenue from operations stood at Rs 9446.76 crore in the reported quarter, up 10.8% from Rs 8522.98 crore in the year-ago period.

Jubilant FoodWorks: The company’s consolidated net income rose year-on-year to Rs 116.11 crore in Q4FY22 as against Rs 104.30 crore in the same period last year. Its revenue rose to Rs 1,157.89 crore in the reported quarter compared with Rs 1,025.86 crore in the year-ago period. Shares of the company closed 9.6% higher.

The company’s board recommended a dividend of Rs 1.20 per equity share of face value of Rs 2 each. It also recommended a dividend of Rs 1.20 per equity share of face value of Rs 2 each for FY22. It also approved the appointment of Sameer Khetarpal as CEO and MD, with effect from September 5, 2022, for a period of five years.

JSW Steel Ltd: The steel producer will continue to supply products to its buyers in Europe without passing on any increase in costs despite New Delhi’s decision to impose an export tax, Reuters reported citing a senior company official.

Mahindra & Mahindra (M&M): The auto major said it is planning to launch a fully electric version of its XUV 300 SUV in the market in the first quarter of next year. The company also announced that it will unveil its electric vehicle business strategy, ‘Born Electric Vision’ of EV concept in August this year.

Dixon Technologies: The company’s consolidated net profit jumped 36% to Rs 63 crore in Q4FY22 as against Rs 46.4 crore in Q3FY22. Its consolidated revenue was down 3.9% to Rs 2,953 crore as against Rs 3,073 crore in the previous quarter of FY22. EBITDA was up 14.7% to Rs 118.2 crore in the reported quarter from Rs 103 crore in Q3FY22. Shares of the company closed 11.2% higher.

Fine Organic Industries: The company’s consolidated revenue jumped 91% YoY to Rs 618.86 crore in Q4FY22. Its net profit rose nearly three-fold to Rs 121.85 crore in the reported quarter. The company’s board recommended a final dividend of Rs 9 per equity share.

Strides Pharma Science: The company said that it subsidiary has secured approval for Ibuprofen Oral Suspension from the US health regulator. The drug is used to relieve pain from various conditions such as headache, dental pain, menstraul cramps, muscle aches, or arthritis. The drug will be manufactured at the company’s facility at Bengaluru.

Mawana Sugars: The company’s consolidated net profit fell 76.4% YoY to Rs 31 crore as against Rs 131.2 crore in the year-ago period. The consolidated revenue was down 17.1% YoY to Rs 294 crore in Q4FY22 compared with Rs 354.7 crore in the same period last year.

Timken India: The company’s shares rose nearly 15% in intraday trading after the company’s net profit surged 128.87% to Rs 121.30 crore on 40.39% rise in net sales to Rs 667.40 crore in Q4 March 2022 over Q4 March 2021. Shares of the company zoomed 9.81% on Monday.

Natco Pharma: The company’s consolidated revenue was up 80% YoY to Rs 597 crore as against Rs 331 crore in the year-ago period. The company registered a net loss of Rs 51 crore in Q4FY22 compared to a net profit of Rs 53 crore in the same period a year ago.

Ethos: Shares of the luxury watches retailer fell on debut after its initial public offering saw tepid demand. The stock got listed at Rs 825 apiece on the NSE, a discount of 6.04% to its IPO price of Rs 878 apiece. Shares of the company close Rs 803.1 apiece.