Search for an answer or browse help topics

Placing GTT and Multileg Orders

Good till triggered (GTT) product is like an order that stays active across multiple trading sessions until the trigger condition is met in the segment where you have placed the order. In GTT You may either place a buy or sell order with the conditions to trigger the order.

It is valid for a period of one year from the date it is placed or for a day, i.e when you place the order you have to select the validity as GTT. If the trigger is hit and an order is placed to the exchange, the trigger is deactivated.

Below are the Alert conditions which you can set as a Trigger:

- LTP – Last Traded Price

- Change – Change in Value

- ATP

- OI – Open Interest

- 52 High

- Volume

Note: If the order is executed at the exchange on the same day and you wish to carry the same, then you need to place a fresh GTT order.

How to Place GTT Order?

- Under MarketWatch Keep your mouse on the scrip name and click on the show menu icon().

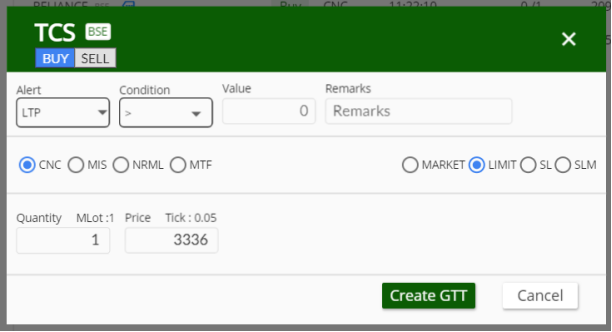

- Select Create GTT and the below order Form will open.

- Now select the alert type and condition

- Enter the Value and Remarks

- Select the order type and enter QTY and price.

- Click on Create GTT.

Multileg Order:

Multileg order is an IOC (Immediate or Cancel)Market order, where you can place 2Leg /3Leg orders by hedging the positions either in options or in futures for scrips of the same group. This is a derivative product and can hedge the positions across the derivative products.

Understanding Multi-leg order strategies:

Straddle: Straddle strategy involves buying a call and put options simultaneously at the same strike price with the same expiry date and underlying asset.

Strangle: Strangle strategy involves buying a call and put options at different strike prices with the same expiry date and underlying assets.

Ratio Spread: Here, the investor holds an unequal number of long and short options simultaneously.

Butterfly spread: It combines the bull and bear spreads with a fixed risk and capped profit. It usually involves four options contracts with three different strike prices, but the same expiration.

Strategies can be created based on the below derivative groups, where Multi leg orders can be placed in these 6 different groups of stocks/ index:

- Group1: Nifty Options

- Group2: Index Futures

- Group3: Stock F&O symbol starting A – G

- Group4: Stock F&O symbol starting H – M

- Group5: Bank Nifty Options

- Group6: Stock F&O symbol starting N – Z

Place Multi-leg order:

- Under MarketWatch Keep your mouse on the scrip name and click on the show menu icon().

- Select Multileg order option

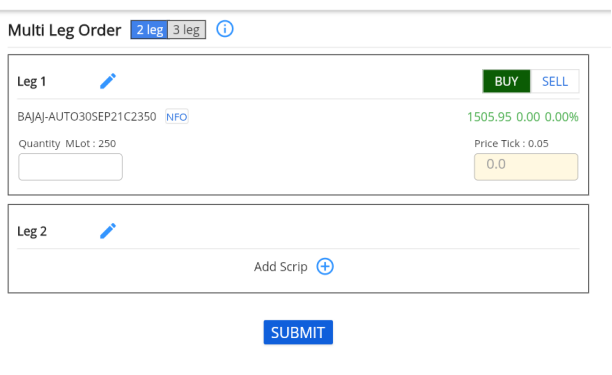

- By Default the two-leg order will be selected, you can also select 3leg.

- Enter the Quantity in lots in the Leg 1 section.

- Click on the add scrip in the leg 2 section to place the 2ndleg option

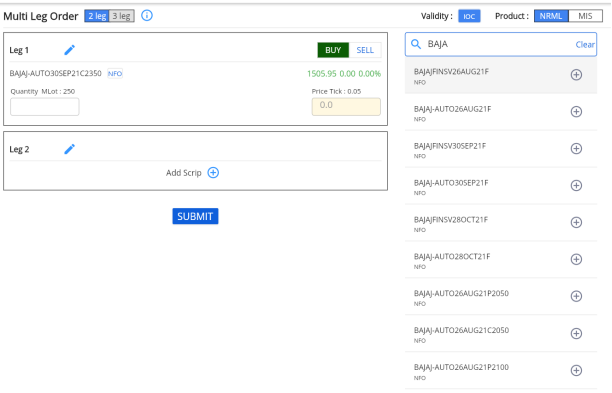

- In the search area, type the contact name and click on the icon

- Now enter the qty in Lots and select the type of order as BUY or Sell

- Click on submit to place the multileg order.

Note:

- You have to choose the scrips as per the above group.

- Since it’s an IOC Market order, the price will be zero and there won’t be any pending order.

Web Trading

Web Trading Backoffice

Backoffice IPO Apply

IPO Apply Manage Account

Manage Account Wall

Wall Kosh

Kosh