Search for an answer or browse help topics

Placing Orders

To Place an order you can able to place either from MarketWatch or from the Search option:

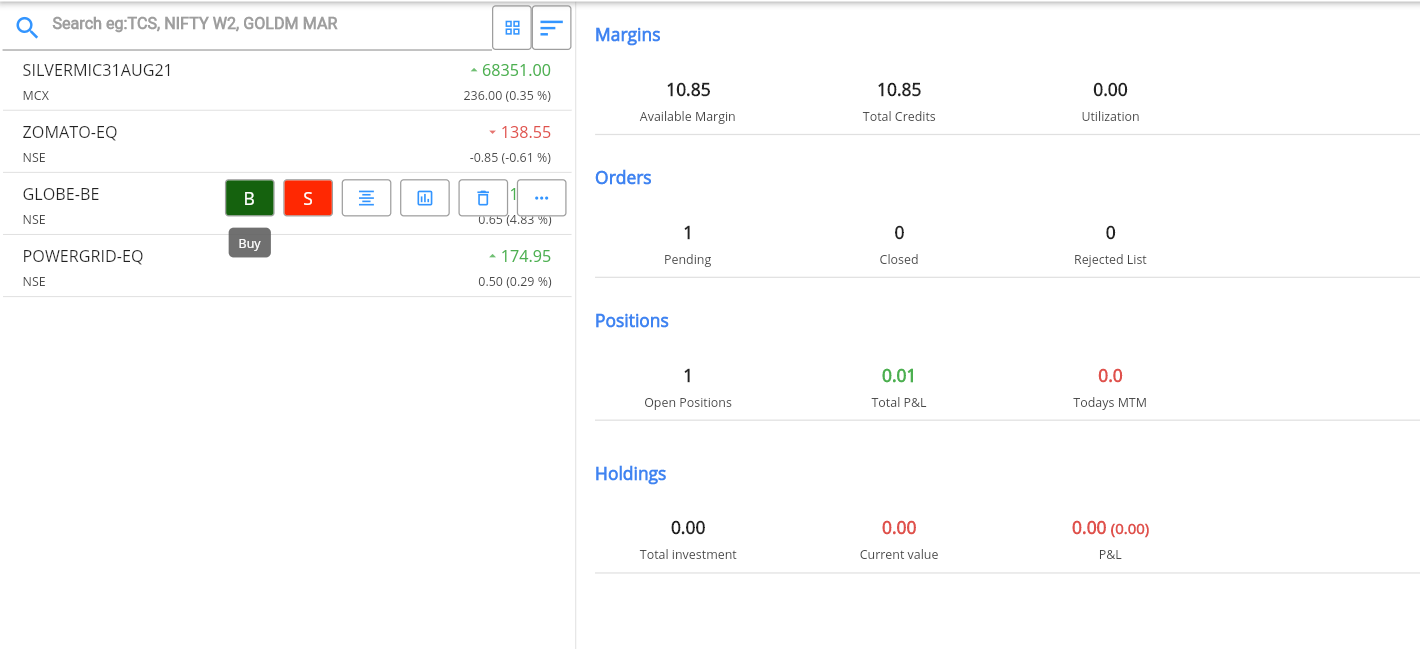

Order From Marketwatch – Keep your Mouse on the Stock/Contract, Select Buy for Buy order and Sell for Sell order.

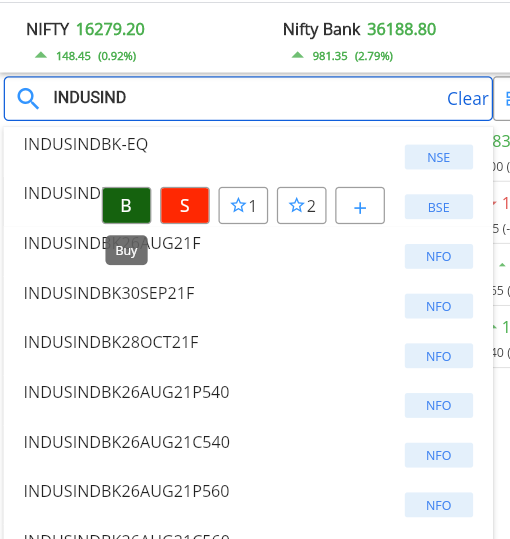

Order from Search – Type the Stock or Contract in the Search window

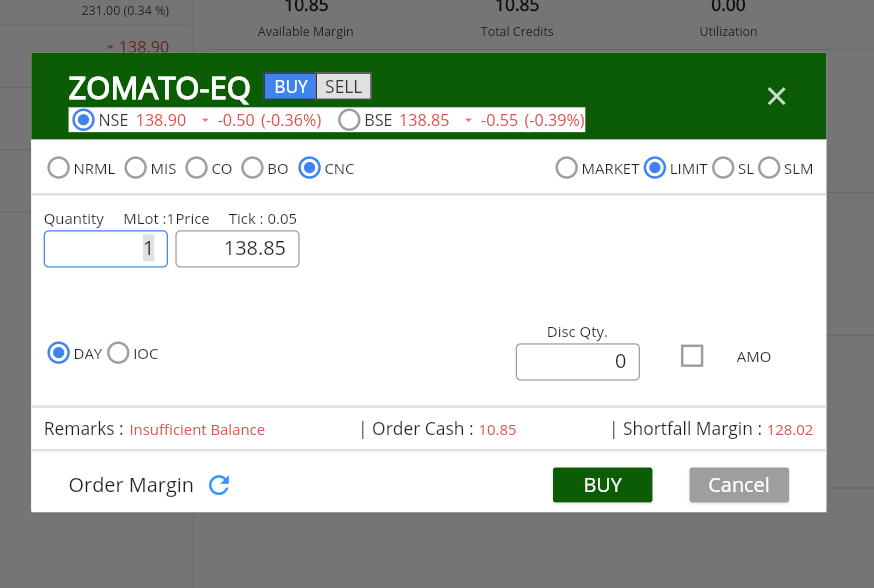

Floating Order Form:

You can move the order window wherever you want, by just doing click on the order form and drag across the screen.

Products

| Margins and Exposure | ||||||

| Products | Type | Equity | Equity Futures | CDS | MCX and EQ Futures/options selling | EQ/ MCX options BUY |

| MIS (Margin intraday square off) | Intraday with auto square-off | up to 5 times leverage on the group 1 stocks. | 100% of Premium Value | 100% of Premium Value | 100% of Premium Value | 100% of Premium Value |

| NRML (Normal) | Delivery / carry forward | 100% of Premium Value | 100%of Exchange margins | 100 of Exchange margins | 100 of Exchange margins | 100% of Premium Value |

| CNC (cash and carry) – | Delivery | 100% of the Value of the Purchase | 100% of Premium Value | 100% of Premium Value | 100% of Premium Value | 100% of Premium Value |

| MTF | Delivery | VaR + 4 times applicable ELM with a minimum margin of 25% on Group I stocks available for trading in the F&O segment and VAR + 6 times ELM with a minimum margin of 25% on other approved stocks | NA | NA | NA | NA |

Placing Various order types

Limit Order:

Using Limit order User can place Buy or Sell order at a predetermined price. This type will be selected by default

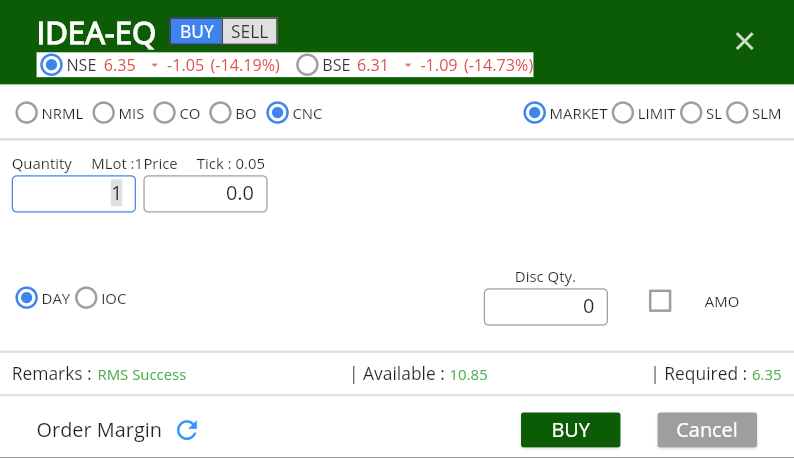

Market order

Users can place the buy or sell order to be bought or sold at the best available price.

To Place a Market order, Select order type as MARKET in the order form. The price will be turned to Zero and now click on submit.

Stoploss Order – SL

Stoploss orders are used to limit your loss with the help of trigger price. Using SL you can place both Limit order(SL ) and Market order (SL-M)

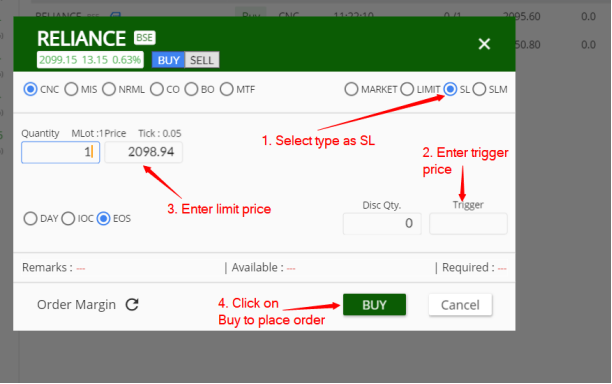

For BUY SL limit order, the Trigger price should be less than limit price and For SELL SL limit order, the Trigger Price should be greater than the limit price.

Once the trigger price reaches, the limit order will be enabled as pending order and the order will be completed once the limit price reaches.

How to place SL-Limit Order:

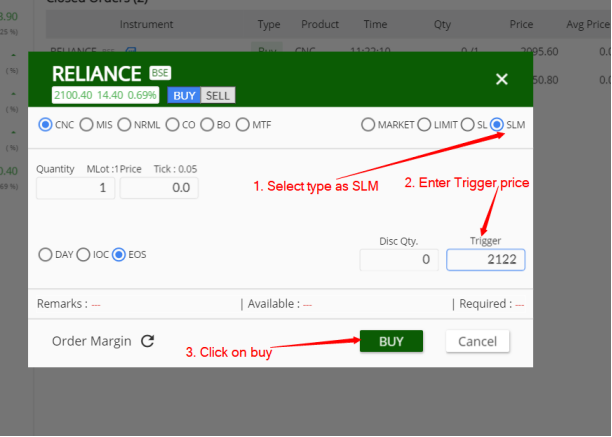

For guaranteed execution, always use SL-M.

Once the trigger price reaches, the order will be enabled as market order and it will be completed at the Market price

How to Place SL-M order

Cover Order:

Cover order is two-leg order, where you can place an initial order to create a position and the second order is an opposite order to restrict your losses. It is an intraday product where your CO orders will be automatically squared off around 3:20 PM.

- Initial Order ——> Limit or Market order

- Cover Order ——> Stop-loss order

If the initial order is Buy, then the cover order will be Sell order likewise Initial order is Sell, then the cover order will be Buy.

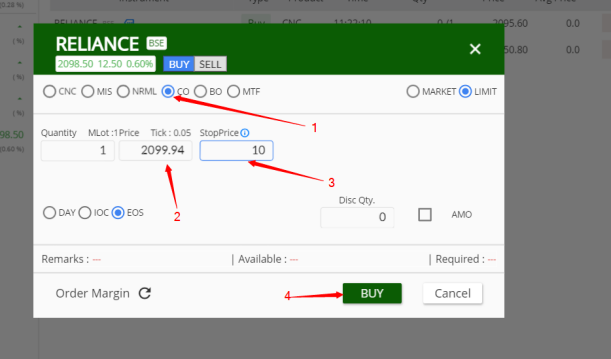

How to place Cover Orders:

- Select Product type as CO

- Enter the limit Price

- Enter the Stop price in absolute Value (Ex: If your limit price is 2099 and the Stop loss is at 10, then the Trigger price for the SL order will be 2089).

- Click on buy to Place the Cover order.

Modification of Cover Order:

- If the initial order is not traded, the limit price and the stop loss can both be modified

- If the initial order is traded, only the stop loss price can be modified.

Bracket order:

Bracket order is three-leg order which helps you to reduce your losses with the help of Stop Price and book profit using the Target order. It is also an intraday product where your BO orders will be automatically squared off around 3:20 PM at the Market price.

- Initial Order ——> Limit or Market order

- Stop price Order ——> Stop-loss order

- Target Order ——-> Stop-loss order.

If the initial order is Buy, then the stop price and Target order will be Sell order likewise Initial order is Sell, then the stop price and Target will be Buy.

It is also known as OCO One Cancels Other, whenever the target order gets executed, the pending stop loss order gets canceled and vice versa.

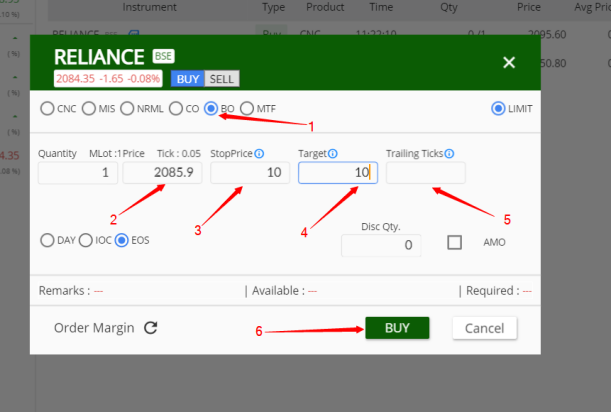

How to place Bracket Orders:

- Select the Order Type as BO

- Enter the limit price

- Enter the Stop price in absolute Value (Ex: If your limit price is 2099 and the Stop loss is at 10, then the Trigger price for the SL order will be 2089).

- Enter the Stop price in absolute Value (Ex: If your limit price is 2099 and the Stop loss is at 10, then the Trigger price for the SL order will be 3009).

- Enter the Trailing Ticks, if required or leave this blank

- Click on Buy.

Modification of Bracket Order:

- if the initial order is not traded, the limit price and the stop loss, target can be modified

- If the initial order is traded, only the stop loss price or target can be modified.

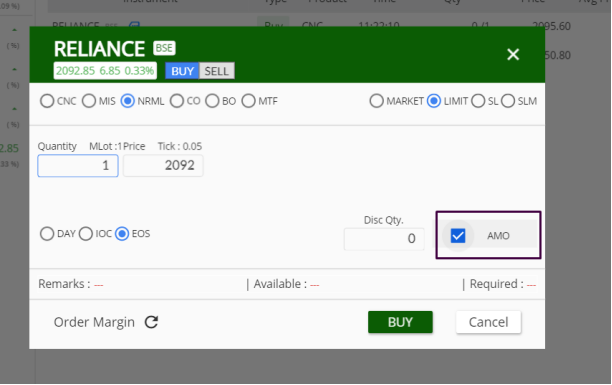

After Market Order (AMO):

Using AMO orders, you place the order for the next trading day the previous day itself. AMO can be placed during the below time window:

Equity/ Equity Derivatives – 5.00PM T-Day to 9.00AM T+1 day

Currency – 6.00PM T-Day to 9.00 AM T+1 day

Commodity – 12.00 AM to 9.00AM

Using AMO you are allowed to place only CNC/NRML/MIS order.

How to Place AMO Order:

In the Order form, click on the AMO check box and click on Buy/ Sell.

Web Trading

Web Trading Backoffice

Backoffice IPO Apply

IPO Apply Manage Account

Manage Account Wall

Wall Kosh

Kosh